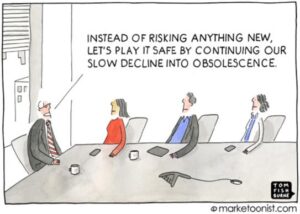

The drive for “sustainability” is powering the green movement and much of the electrification initiatives that are supporting the electrical industry, culminating in sales for distributors and manufacturers. From a more all-encompassing viewpoint, the term “sustainability” represents even broader initiatives